- YieldStacker

- Posts

- The Money Train Switches Tracks: Bitcoin ➜ Ethereum ➜ Everything Else

The Money Train Switches Tracks: Bitcoin ➜ Ethereum ➜ Everything Else

The Money Train Switches Tracks: Bitcoin ➜ Ethereum ➜ Everything Else

🚀 Your Weekly Playbook for Maximizing Yield in DeFi

📅 20 July 2025 | 💰 ETH: $3 732 | BTC: $117 367 | SOL: $178 | 🌐 Market Mood: Greed (72)

TL;DR market pulse:

Bitcoin is drifting, Ethereum is holding ETF‑fed strength, and smaller caps are catching fresh bids—classic early‑altseason behavior. Liquidity is flowing down the risk curve, on‑chain fees are ticking up, and the Greed index sits firmly above 70. Position size accordingly: keep a core in majors, but be ready to farm the volume spillover.

📖 New to DeFi? 👉 Read the Ultimate Beginners Guide

Big Story: Institutional ETH demand just leveled up

Why we’re talking about this

Spot‑ETH ETFs are barely a month old, yet they’ve already soaked up ≈ 545,000 ETH—about $1.6 billion. That’s one‑third of Bitcoin’s first‑month haul, even though ETH issuance is negative. Let’s unpack what changed, what it signals, and where the yield lives.

What just happened

First came the numbers: day after day, inflow prints showed tens of thousands of ETH leaving exchanges and sliding into ETF custody wallets. Traders noticed when the 30‑day total crossed half a million ETH. Supply on Coinbase and Kraken keeps creeping lower.

Next came the headline: Tom Lee popped up on CNBC, waved his spreadsheet, and said, “At this pace, fair value is ten‑to‑fifteen‑thousand dollars per ETH.” Whether you believe the math or not, the clip raced through Crypto‑Twitter and woke up every CIO who missed the first Bitcoin ETF wave.

Then corporate money made it tangible. SharpLink Gaming, a midsize i‑gaming company that nobody outside sports betting follows, quietly filed an 8‑K: they’d bought 280,706 ETH, staked all of it, earned 415 ETH in roughly six weeks, and now want to raise another six billion dollars to buy more. That stash is larger than the Ethereum Foundation’s liquid balance.

Put together, you get a simple picture: ETFs are locking up fresh ETH, analysts are ratcheting up targets, and at least one corporate treasury has shown its board that staking yield = productive cash.

Why it matters to yield‑stackers

• What changed | • What it means for you |

|---|---|

ETF flow removes float | Less tradable supply → more swap volume on ETH pairs → higher LP fees. |

Treasuries can stake | If CFOs decide staking is “cash‑like,” demand for liquid‑staking tokens (stETH, swETH, weETH) rises, and staking APY holds up. |

ETF investors earn 0 % | The staking yield they forgo—plus bribes, plus LP fees—remains on‑chain for you to capture. |

Take‑action tip: Hold at least one liquid‑staking token and consider seeding a wide‑range ETH/USDC pool. You’ll collect staking yield and the swap fees the ETF pipeline generates.

(Disclaimer: This is not financial advice. Always DYOR—Do Your Own Research.)

Yieldstacker Strategy of the Week: Loop & LP: Use your ETH twice

Earn swap fees on an ETH‑USDC pool without selling any ETH by borrowing stablecoins against the ETH you already hold.

Quick refresher

Looping means you deposit an asset as collateral, borrow against it, buy more of the same asset (or its pair), and repeat until you reach a comfortable loan‑to‑value (LTV). It lets you stay long while squeezing out extra yield from a liquidity‑pool position.

Key numbers right now (Base network) | Value |

|---|---|

ETH supply APY on Aave V3 | ~2 % |

USDC variable borrow APY | ~5.6 % |

30‑day fee APR on the ETH/USDC 0.3 % pool (wide range) | 55 – 70 % (Revert dashboard) |

The spread between fee income and borrowing cost is the opportunity.

Step‑by‑step (guide below)

Deposit ETH on Aave V3 (Base)

Why? It earns a small supply APY and unlocks borrowing.

Hand‑check: After deposit, note your health factor—keep it above 1.5.Borrow USDC at ≤ 40 % LTV

LTV is borrowed value ÷ collateral value. At 40 %, ETH can fall ~35 % before liquidation risk gets serious.Swap half of that USDC back into ETH

Now you hold equal values of ETH and USDC—perfect for a 50/50 liquidity pair.Provide liquidity to an ETH/USDC pool

Choose a protocol that matches your style:Protocol

When to choose it

Pool link

Revert Finance

You want full control: pick your range, see IL calculators, no auto‑compounding.

Vfat.io

You want full control: pick your range, auto harvest, and auto compounding features

Aerodrome (Base)

You’re happy staking veAERO or renting bribes to boost APR 10‑20 %.

Range suggestion: ±35 % around the current price keeps you in the game for a typical month’s volatility.

Harvest weekly and watch your health factor

If ETH rallies significantly, your loan appears safer, meaning your LTV decreases. If ETH dumps ≈15‑20 %, pay back a slice of the USDC loan to keep HF > 1.5.

Pros and cons at a glance

✓ Benefits | ⚠️ Trade‑offs |

|---|---|

Earn fees and keep long ETH exposure | Borrow costs rise when USDC demand spikes |

Can auto‑compound (Beefy) or DIY (Revert, Vfat) | Impermanent loss if ETH overperforms USDC by > 45 % before you collect fees |

Works on one chain (Base)—no bridge gas | Liquidation risk if ETH crashes quickly |

First‑timer checklist

✅ Write down your liquidation price (Aave UI shows it in real time).

✅ Start small; loop once before stacking leverage.

✅ Schedule a weekly reminder to harvest fees and repay interest.

✅ If the pool’s fee APR drops below your borrow APY + 10 %, consider unwinding.

Master this loop once, and you’ll have a reusable template whenever ETH volatility spikes. More questions? Reply to this email and we’ll point you to a detailed walk‑through thread.

DeFi Radar — This Week’s 60‑Second Briefing

🔗 | What’s happening | Why it matters |

|---|

U.S. policymakers are drafting a plan to let the Treasury hold Bitcoin alongside gold. Announcement expected on 22 July. | If the government starts buying Bitcoin, it could pull money away from smaller coins. Keep an eye on how ETH and other alts react. |

Several blockchains built on Optimism (OP Mainnet, Base, Mode) will soon share the same backend, making transfers cheaper and faster. | Easier, cheaper moves between these chains should bring more users and higher trading fees, good for anyone providing liquidity there. |

Jupiter teaser | Solana’s top swap site hinted it will add simple “options” trading next week (options = the right to buy or sell a token later). | A new trading feature usually comes with bonus rewards; early liquidity providers and JUP stakers often get the first boost. |

Deep Dive: So you’ve heard people whisper “altseason.” What does it actually mean?

Bitcoin is still crypto’s index, but it doesn’t own every rally. After BTC has a strong run and starts to flatten, traders with fresh profits look for higher‑beta opportunities. Liquidity flows “down the risk curve” into Ethereum first, then Layer‑2 tokens, and eventually into mid‑caps and newer projects. This rotation—short or long—gets labeled altseason.

Think of it as a compressed market cycle inside the broader bull run: Bitcoin slows, Ethereum outperforms, smaller caps follow, fees on DEXs spike, and eventually, profit‑taking sends capital back up the curve.

Why it matters to you

Token performance: In past altseasons, the non-BTC market cap has climbed by +200 % to +1000% in just a few months. Translating that to a portfolio: if you’d started with $1000 in a solid alt basket, a +200 % cycle grows it to $3 000, a +500 % cycle to $6 000, and a full +1 000 % run would show about $11 000 on your screen. 🤯

Fee opportunity: When money shifts into smaller tokens, trading activity on ETH and alt pairs jumps. More trades mean higher transaction fees, and liquidity providers share that pool. Even a small ETH/USDC position can earn more when this happens.

A look back at recent altseasons

Period | BTC dominance drop | Rough change in alt‑market cap | Stand‑out moves |

|---|---|---|---|

2017 (ICO boom) | 86 % → 38 % | ≈ +1300 % | ETH from $8 → $1 350; many mid‑caps 10–50×. |

2021 (DeFi & NFTs) | 70 % → 40 % | ≈ +900 % | SOL from $3 → $250; DeFi tokens 5–15×. |

2023 mini‑cycle (L2 & memes) | 53 % → 49 % | ≈ +75 % | BASE memes (TOSHI, BRETT) multiples in weeks; OP and AERO fees doubled. |

Today (early 2025 signs) | 66 % → 61 % (last 3 wks) | still forming | Rising L2 volumes, Google “altcoin” searches at all‑time high. |

Source figures aggregated from CoinMarketCap dominance charts and total altcoin market‑cap data.

Altseason is not guaranteed every cycle, but when the signals line up, meaning Bitcoin dominance breaks down and non‑BTC volumes climb, then we are almost guaranteed to see both price appreciation for smaller tokens and a jump in fee income for liquidity providers. Watching those indicators helps you decide when to shift part of your focus away from Bitcoin and toward the broader market

(Disclaimer: This is not financial advice. Always DYOR—Do Your Own Research.)

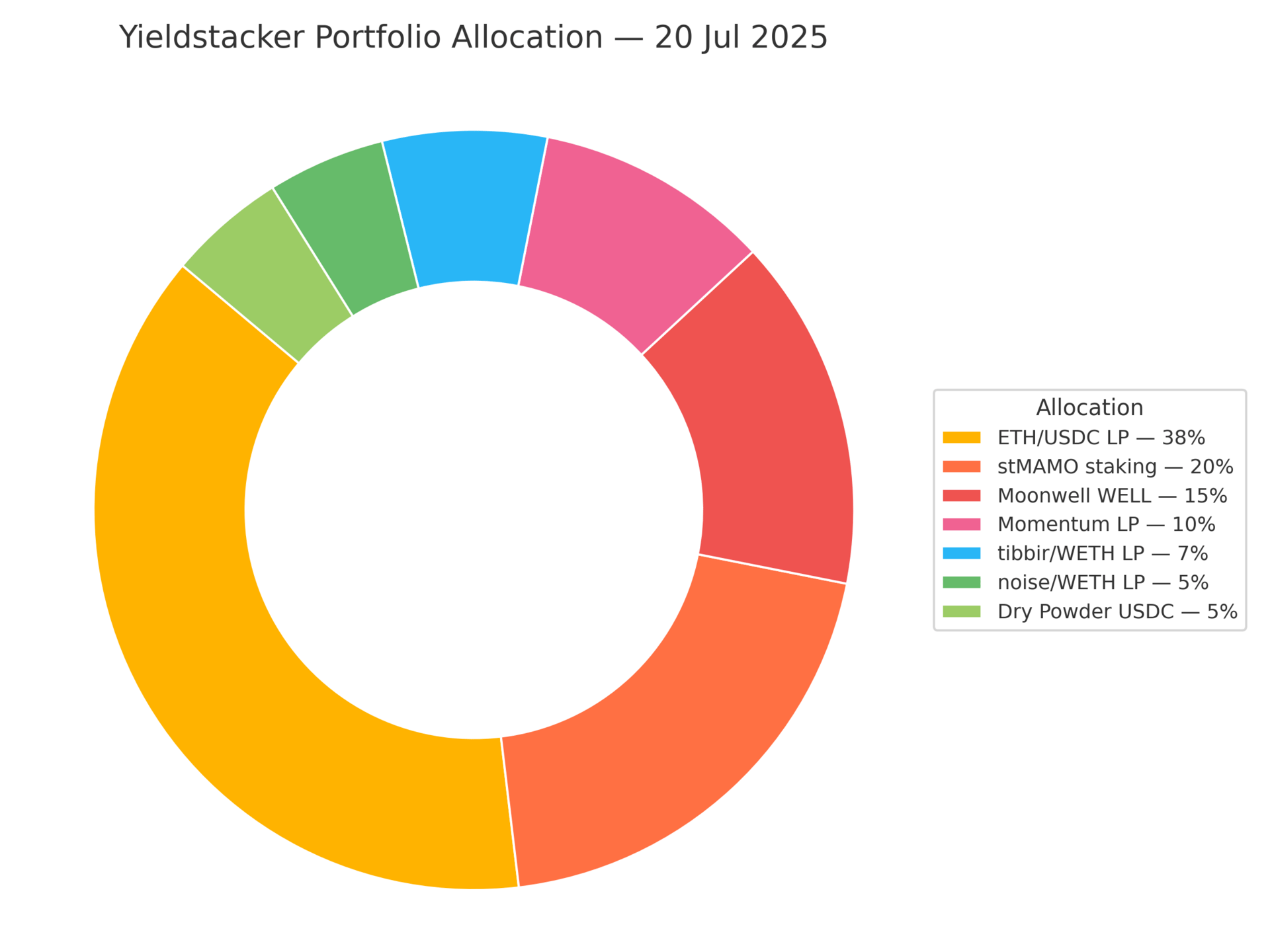

The Yieldstacker Portfolio

🔄 Want the full playbook: how we pull ~70% APR from ETH/USDC and how stMAMO earns 20% without impermanent loss?

Become a Paid Subscriber Now to access our full vault strategy, allocation breakdowns, and weekly rebalance insights.

🔄 What changed, and the thinking behind it

HAEDAL/USDC → out, funds to Base.

Rewards were tapering; we prefer fresh gauges on Base, so the capital moved there.SUI/USDC on Cetus → closed, rolled into ETH.

Incentives ended,d and fees fell below 5 %. The proceeds were added to our core ETH to sharpen ETF‑driven exposure.MAMO LP → converted to stMAMO staking.

Staking gives ~20 % without impermanent‑loss risk, matching our medium‑risk bucket.Added tibbir/WETH and noise/WETH (small size).

High‑volatility Base gaming tokens—upside optionality with limited portfolio impact.ETH/USDC weight increased.

ETF inflows keep swap volume high; a larger slice here means steadier fee income.Kept 5 % USDC dry powder.

Ready cash lets us jump on the next bribe window or incentive launch without selling winners.

Why we run the stack this way

Core stability: ETH positions (LP + staking) anchor the portfolio.

Targeted torque: Smaller caps and Momentum LP chase upside but are sized so a single misfire can’t sink the ship.

Cash flexibility: A fixed USDC slice means we never have to unwind a good farm just to enter a new one.

Yields move block‑by‑block; always confirm in‑app before copying.

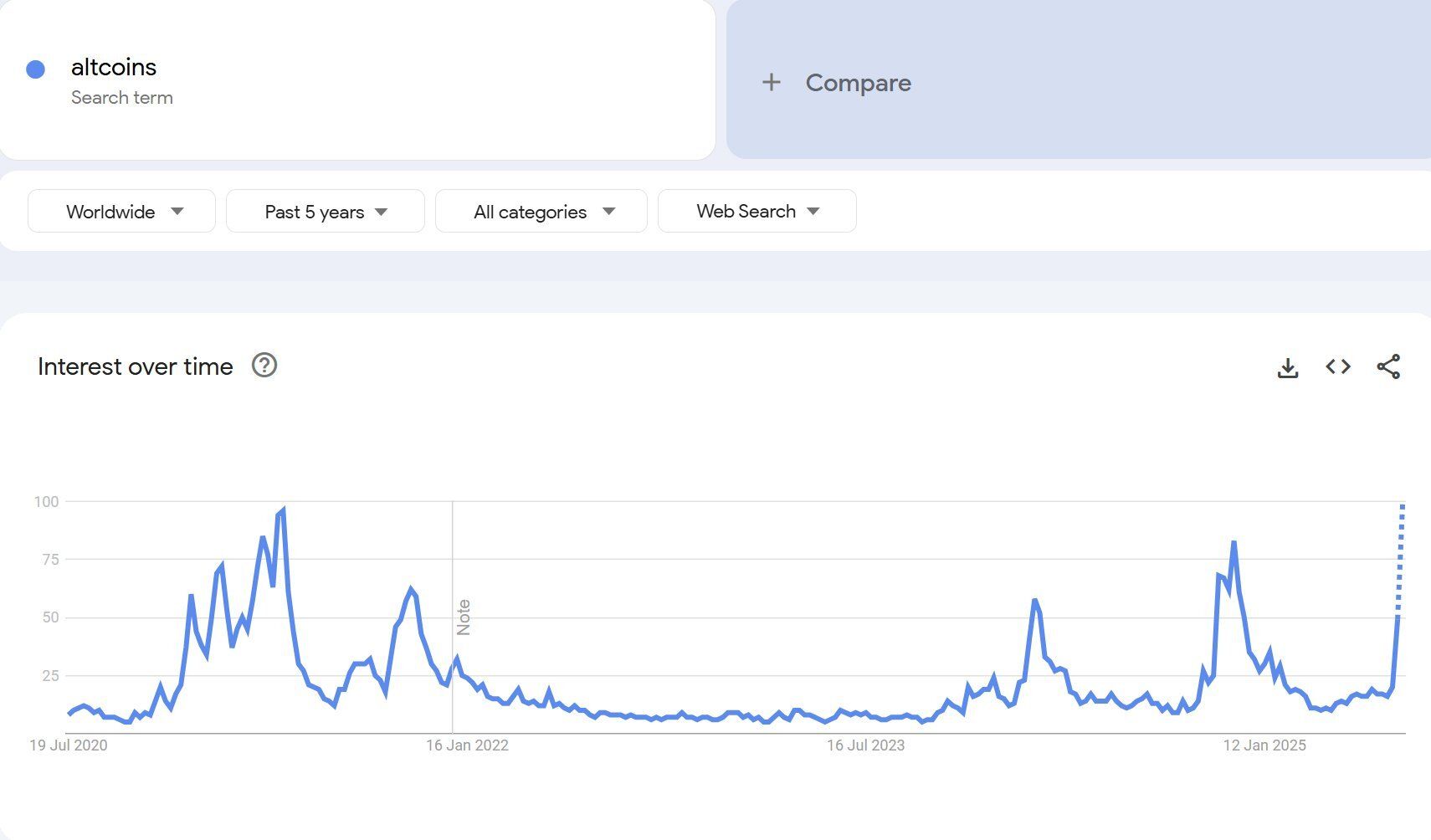

Chart of the Week: Guess who’s back 🤝 Back again — retail’s back, tell a friend

Google‑Trends interest for “altcoins” (worldwide, past five years).

Retail search for “altcoins” just printed a fresh five‑year high.

In the last two cycles, similar spikes (2021 and early 2023) were followed by a sharp rise in non‑BTC market cap and a noticeable jump in DEX trading fees. Rising curiosity often shows up a few weeks before new capital, keep an eye on swap volume through August.

Beginner Mistake to Avoid — thinking every “altseason” token will keep climbing

When searches spike and Twitter feeds fill with double‑digit charts, it’s easy to believe any coin that moves today will move tomorrow. The reality: most turnover happens in the first burst of liquidity, and late entries can get stuck in thin markets.

Common slip‑up | What actually happens | Simple guard‑rail |

|---|---|---|

Buying thin tokens after a big green candle | Early buyers exit their position; volume dries up, and price drifts. | Check 24‑h volume and slippage. If $500 moves the price more than 2 %, size down or wait. |

No exit plan | Profit evaporates while you decide when to sell. | Pre‑set a rule: trim 25 % at +100 %, another 25 % at +200 %. |

All in one basket | One project delay or exploit wipes out your gain. | Spread alt bets; cap any single position at 5–7 % of your stack. |

Bottom line: altseason rewards speed and discipline. Enter small, exit on schedule, and keep most of your capital in liquid majors that won’t vanish overnight.

Stay Connected & Ask Away

Got a DeFi question or feedback on the newsletter? Reply to this email or drop a DM to @YieldSage on X. We love hearing from readers.

Follow us on X for real‑time charts and threads.

Want to sponsor an issue and reach a growing community of crypto yield hunters? Email [email protected] for rates.

And if you found today’s insights useful, forward this issue to a friend who’s new to DeFi—help them start stacking yield the smart way.

Disclaimer (read this 👀)

YieldStacker is not a broker, tax adviser, or investment adviser. All content is educational and for entertainment only—nothing here is an offer, recommendation, or solicitation to buy or sell any asset. Crypto and traditional securities carry significant risk, including the risk of total capital loss; invest only what you can afford to lose and consult a licensed professional about your specific situation. YieldStacker, its authors, and partners accept no liability for any losses incurred from actions taken based on this publication.